The payback period is the amount of time it takes to break even on an investment. The appropriate timeframe for an investment will vary depending on the type of project or investment and the expectations of those undertaking it. The answer is found by dividing $200,000 by $100,000, which is payback period formula two years. The second project will take less time to pay back, and the company’s earnings potential is greater. Based solely on the payback period method, the second project is a better investment if the company wants to prioritize recapturing its capital investment as quickly as possible.

What other financial metrics should I use alongside payback period?

To calculate the cumulative cash flow balance, add the present value of cash flows to the previous year’s balance. The cash flow balance in year zero is negative as it marks the initial outlay of capital. Therefore, the cumulative cash flow balance in year 1 equals the negative balance from year 0 plus the present value of cash flows from year 1. The discounted payback period is calculated by adding the year to the absolute value of the period’s cumulative cash flow balance and dividing it by the following year’s present value of cash flows. The standard payback period is simply the amount of time an investment takes to recoup the initial cost.

How to calculate payback period with irregular cash flows

- Any particular project or investment can have a short or long payback period.

- The discounted payback period extends the concept of the payback period by considering the time value of money.

- A higher payback period means it will take longer for a company to cover its initial investment.

- Investors should consider the diminishing value of money when planning future investments.

- For example, if a payback period is stated as 2.5 years, it means it will take 2½ years to receive your entire initial investment back.

It’s essential to consider other financial metrics in conjunction with payback period to get a clear picture of an investment’s profitability and risk. Keep in mind that the cash payback period principle does not work with all types of investments like stocks and bonds equally as well as it does with capital investments. The main reason for this is it doesn’t take into consideration the time value of money.

Advantages and disadvantages of payback method:

The equation does not calculate cash flows in the years past the point where the machine is expected to be paid off. The payback period method is particularly helpful to a company that is small and doesn’t have a large amount of investments in play. This 20% represents the rate of return the project or investment gives every year. The payback period doesn’t take into consideration other ways an investment might bring value, such as partnerships or brand awareness. This can result in investors overlooking the long-term benefits of the investment since they’re too focused on short-term ROI.

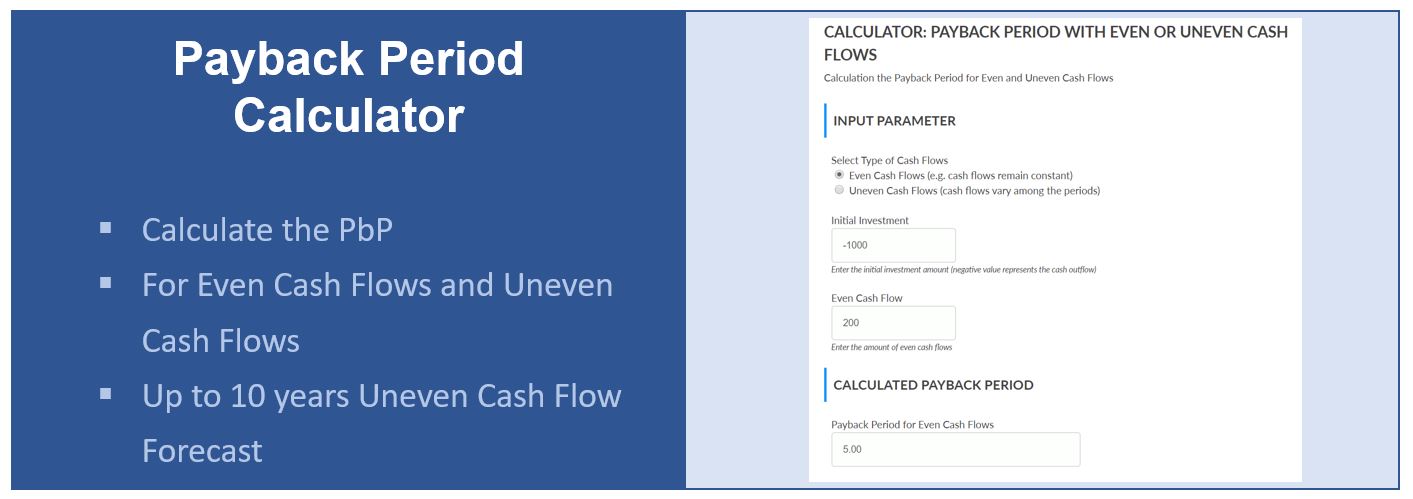

Example 1: Even Cash Flows

Companies also use the payback period to select between different investment opportunities or to help them understand the risk-reward ratio of a given investment. Prior to calculating the payback period of a particular investment, one might consider what their maximum payback period would be to move forward with the investment. This will help give them some parameters to work with when making investment decisions. If the calculated payback period is less than the desired period, this may be a safer investment.

To begin, the periodic cash flows of a project must be estimated and shown by each period in a table or spreadsheet. These cash flows are then reduced by their present value factor to reflect the discounting process. This can be done using the present value function and a table in a spreadsheet program. Let’s say the net cash flow amount is expected to be higher, say $240,000 annually.

Fortunately, with the help of Microsoft Excel, calculating the payback period can be a quick and straightforward process. The shorter a discounted payback period is means the sooner a project or investment will generate cash flows to cover the initial cost. A general rule to consider when using the discounted payback period is to accept projects that have a payback period that is shorter than the target timeframe.

In most cases, a longer payback period also means a less lucrative investment as well. A shorter period means they can get their cash back sooner and invest it into something else. Thus, maximizing the number of investments using the same amount of cash. A longer period leaves cash tied up in investments without the ability to reinvest funds elsewhere.

The point after that is when cash flows will be above the initial cost. The payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive, which is the payback year. According to payback method, the project that promises a quick recovery of initial investment is considered desirable. If the payback period of a project is shorter than or equal to the management’s maximum desired payback period, the project is accepted, otherwise rejected. For example, if a company wants to recoup the cost of a machine within 5 years of purchase, the maximum desired payback period of the company would be 5 years.