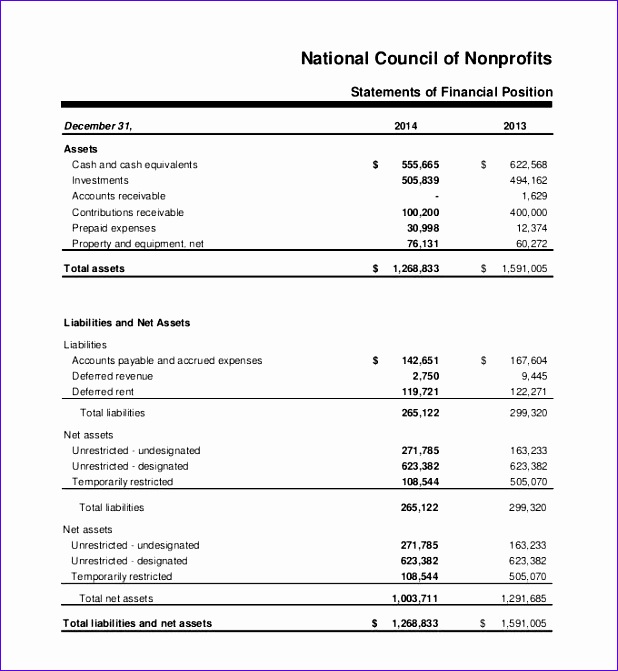

The Statement of Financial Position is the Balance Sheet of a nonprofit organization. It is also worth noting that the valuation of assets is based on their historical cost or fair market value. Historical cost represents the original purchase price of the asset, while fair market value is the estimated price that the asset would fetch in the open market. The valuation method used depends on the accounting policies of the organization.

Changes in Net Assets

Tyler places great emphasis on meticulous attention to detail in financial record-keeping, implementing efficient systems to ensure transparency and streamline operations. One key aspect of the additional disclosures is the disclosure of significant accounting policies. calculate inventory management costs These policies outline the principles and methods used by the organization to prepare its financial statements. They provide transparency and help users of the financial statements understand the basis for recording and presenting financial information.

Interpreting Nonprofit Financial Statements

It allows stakeholders to see the sources of revenue, such as donations, grants, and program fees, as well as the expenses incurred in carrying out the organization’s activities. By analyzing the Statement of Activities, stakeholders can assess the efficiency and effectiveness of the organization’s operations and evaluate its impact on the community. In addition to unrestricted net assets, nonprofit organizations may also have restricted net assets. Restricted net assets are funds that are designated for specific purposes by donors or other external parties.

How to Open a Bank Account for a Nonprofit

Reading and understanding other financial documents, briefly covered below, is necessary to fill the gap. When it’s all put together, a nonprofit statement of financial position is a pretty straightforward document. Putting it together, however, can take time because there are a number of essential components you or your accounting expert will need to assemble. A nonprofit statement of financial position is one of several documents nonprofits can use to demonstrate where donors’ money is being spent. Recognizing net assets with donor restrictions and representing them as such in financial statements is crucial so that organizational decision-makers are aware of obligations in the future.

Contact a nonprofit accountant to craft and interpret your statement of financial position.

Understanding the nonprofit balance sheet is essential for stakeholders to assess financial health, liquidity, and the organization’s ability to fulfill its mission effectively. This method records revenue and expenses in accordance with nonprofit accounting standards. Cash basis accounting is simpler and easier to understand compared to accrual basis accounting, which is commonly used in for-profit organizations. However, it may not provide a complete picture of the organization’s financial health. It is important for nonprofit organizations to carefully consider their accounting policies and choose the method that best suits their needs and goals.

- They are also used for compliance purposes, as regulatory bodies require nonprofits to submit these statements regularly.

- This information is essential for making informed decisions about investments, loans, and overall business strategies.

- For the most part, however, cash flow statements for non and for-profits are very similar.

- This statement is important because it helps stakeholders understand the organization’s ability to generate cash from its operations and how it manages its cash resources.

Why Is a Statement of Financial Position Important?

Nonprofit organizations are required to file financial statements with the IRS to follow compliance laws. However, that is not the only reason why you would want to compile these reports. Preparing detailed financial statements can give you important insights into your organization. It also provides transparency to donors and, in turn, opens up opportunities to solicit significant gifts.

First, they provide transparency and accountability to stakeholders, including donors, board members, and the public. By disclosing the organization’s financial activities and performance, these statements allow stakeholders to assess the nonprofit’s financial health and make informed decisions. Second, nonprofit financial statements are essential for compliance with regulatory bodies. They help ensure that the organization is following accounting standards and reporting requirements. Third, these statements serve as a tool for financial planning and budgeting. They provide valuable information on revenue, expenses, and net assets, which can guide strategic decision-making and resource allocation.

Financial statements serve as a valuable tool for evaluating the financial performance and sustainability of nonprofit organizations. Nonprofit accounting involves recording and reporting financial information for organizations that do not operate to earn a profit. The nonprofit organization’s statement of financial position, also known as the balance sheet, provides a clear picture of the organization’s financial health. It shows what the organization owes and what the organization owns, giving insight into the nonprofit’s financial situation. Financial management is crucial for assessing an organization’s financial position and ensuring its current financial health.